In this post you are going to learn the secret sauce to picking a trustee and learn of America's most advisor friendly trust companies for 2020. Botton line - the best trust companies treat financial advisors like celebrities.

This post also includes lots of:

So, if you want to get GREAT results during your search for picking an advisor friendly trust company, then you will love this post.

Let's dive right in.

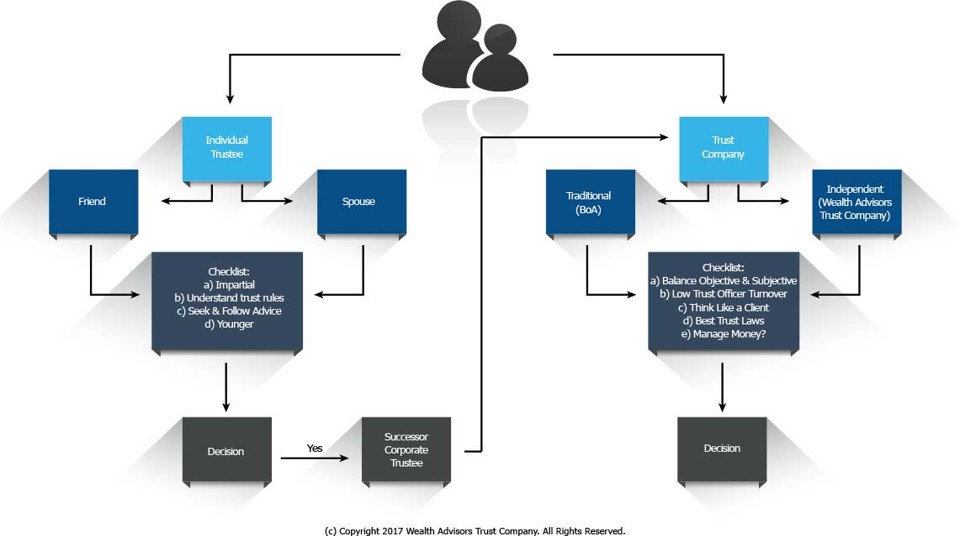

Regardless of the trustee choices available everyone must admit that no pre-ordained choice exists. The right answer for choosing America's advisor friendly trust companies starts with saying they might not be the right answer. It starts with what solution answers and solves the issues and goals for the beneficiary/grantor. Before moving forward below diagram outlines the simple steps anyone can take to picking an individual and/or corporate trustee:

The trustee industry has over 700 years of history. Trust fund law and the evolution of trustee services grew unevenly. Like any industry it can become complacent. Michael Porter, a professor from Harvard Business School (circa 2020), created the 5 forces of understanding competitive forces. Advisor friendly trust companies focus rests on the customer (e.g. beneficiary) and the referral source (e.g. financial advisor and estate attorney). These modern day trust companies also understand the Michael Porter model (i.e. some better than others). Here is the model

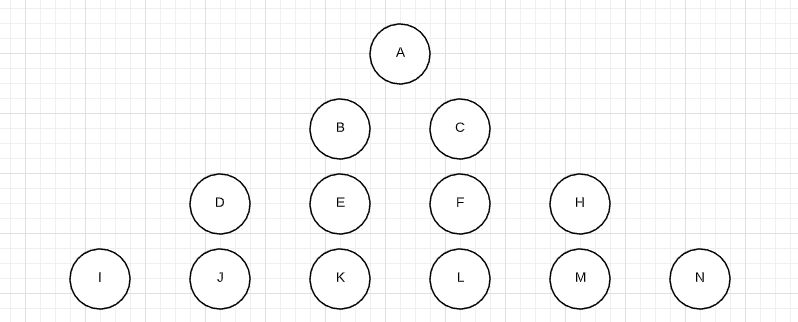

Traditional trust companies (i.e. Northern Trust, JP Morgan, Bank of America, Bessemer Trust, SunTrust etc.) provide wide services with deep history and narrow innovation. Any corporate trustee can be an industry innovator. It just takes passion and intellectual curiosity. And consistency (more on that latter). The act of providing trustee services follows simple steps. There happens to be many of those steps (think of a tree diagram). That tree diagram does not have consistent spaces between each decision and step (see examples below in Process section). It's a labyrinth of decisions. The secret sauce lies in the people, culture and process. Mixing and matching those 3 critical sauce components makes advisor friendly trust companies a lasting solution.

“Working for one of America’s advisor friendly trust companies has been revitalizing. The company culture is framed to propel us to grow through innovation of our trust services. It’s like being on the autobahn in Germany; once you’re on it, the only direction is forward and wanting to experience it firsthand, drives you to go fast.”

Jearon Cambron, Trust Officer at Wealth Advisors Trust Company

The people of the company believe in the DNA of the firm. The job provides an income but also something more. A clear purpose of providing trustee services better and constantly improving. This makes finding the right employees tough. These companies need people who want to have the freedom to do better, figure out more natural solutions and be encouraged to learn through mistakes.

Culture of a company and the people somewhat blend together. The culture explains why a company exists. It explains the motivation for creating the company. The answer should never center on profit and revenue. Those are subsidiary benefits for offering innovative and collaborative trustee services to customers and referral sources. The magic of a company culture starts at the beginning.

"Ask why the company exists? Ask about their DNA?"

Christopher Holtby, Co-Founder, Chief Marketing Officer

Culture changes over time. People change over time. The trustee industry will change over time. Advisor friendly trust companies will always find a way to remain an industry disruptor (well most of them). They started out of frustration with the traditional trust company model. They hire and train employees who want to exist in an environment where change is natural (aka, DMV employees would hate working here).

Leadership Team at Wealth Advisors Trust Company

The process of delivering trustee services does not exist in a vacuum. The process involves many different parties, acting in an arm's length manner, but in a collaborative process. The end result for customer and all referral sources is a natural and easy to use advisor friendly trustee service. The role of an innovative and collaborative trust company begins with making trustee services consistent.

This tree diagram provides an example of experience customers and referral sources should experience with trustee services. The internal process to provide this clean and organized result creates another secret sauce question mark. The process involves many different parties, communicating differently, at different times, sometimes with different agendas, in different time zones, with different education backgrounds of trust law, accounting and procedures but all with the focus of the customer. Whew! Advisor friendly trust companies must find a way to make this all natural and easy to use. Some use SalesForce as the trust administration backbone. They then build many many extra machine learning processes to enhance the experience for the customer and the employees (like us). This process never stops evolving and adapting. It is fun and exhausting at the same time.

"Being ranked as one of America's advisor friendly trust companies does not come easily. We put a significant amount of thought and energy into the behind the scene actions to create a simple and excellent customer experience. Thinking of efficient and innovative trust systems and operations keeps me motivated. It is a job, or really a craft, that never stops adapting to people and technology.”

Jami Kuchenbecker, Senior Trust Administrator at Wealth Advisors Trust Company

The trustee industry changes over the last 3 decades have been titanic. It started with dynamic trust law changes in DE and then moved onto SD, NV and AK. The top ranked trust law states (basically 7 of them), offer the best options for anyone. Kinda like have 31 flavours at Baskin & Robbins.

Hint: Make sure your trust and estate attorney allows for the governing law to be changed by the corporate trustee for situs and trust administration. You always want the option to move the governing law based on the best trust laws. Today it may be South Dakota trust law, but tomorrow it may be WY. You just want those choices.

The big changes coming to the trustee industry centers on technology, marketing and general innovation. America's advisor friendly trust companies focus centers on these issues (some more than others).