In this blog post you are going to learn ideas and suggestions to potentially limit the “hit” from Joe Biden’s tax plan. This post will include:

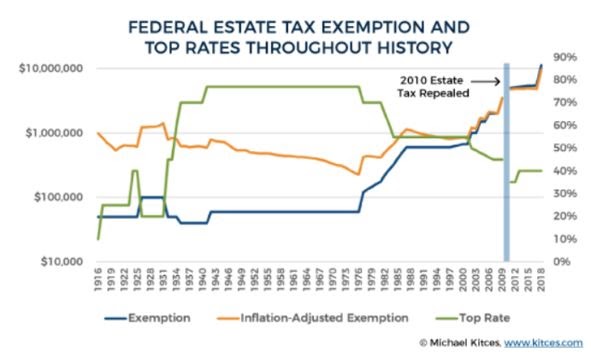

With the widening wealth gap, which has been increasing over the last 30 years, the rift between the Democrats and Republican tax policies have increased at the same rate as the wealth gap. Don't shoot the messenger here as I am just explaining where we exist today. We can all agree that the Democrat tax plan, with the influence of Senators Bernie Sanders and Elizabeth Warren, might be referred as “tax hike joe.” It appears their Democrat estate tax proposal looks to revert plans enacted by the current Republican administration. This means any planning, such it be warranted, needed or wanted by you, should commence now. Historically America has a long tradition of parties enacting somewhat drastic changes to estate, SALT and income tax plans. Being aware is being prepared. All the information below is provide information for planning discussions and is not a commentary on which Presidential candidate is better.

Northern European countries are known for their wide and deep social safety nets. This requires a hefty size of taxes from the corporate and individual groups to pay for this level of coverage. For example, the tax-to-GDP in 2018 for Norway was 39%, Sweden was 43.9% and 24.3% for America. The Scandinavian countries have consumption taxes almost 3x larger than America. This allows those countries to expand the master amount of social safety nets. The Democrats tax plan looks to thread the needle on removing the wealth gap and funding a large social safety net. Philosophically, the Democrats and naturally Biden’s tax plan looks to emulate various versions of those Scandinavian countries. This type of influence will run it’s natural progression. Again, this is not a commentary of whether this is good or bad but merely to inform the readers how entrenched these income tax policies. The good news - tax policies are like Texas weather - wait awhile and it will change.

What's in it for you subscribing to OPEN WINDOWS newsletter

The Joe Biden Tax Plan mixes center and left of center tax policies. That is not a commentary of the pros or cons of that approach just an observational fact. The 2020 presidential election is less than four months away and, depending on the results, changes in tax legislation that impact clients could be heading our way. The Democrat tax increase proposal, should they win the White House and a combination of the House or Senate will have long term effects. We all know that tax legislation can take months to enact after it is initially proposed. However, with trillions spent on stimulus (and potentially trillions more), the ongoing pandemic and reduced tax revenue, tax reform could occur no matter who is elected in November. Given Joe Biden’s existing platform plus Biden’s tax plan with the potential adoption of certain Bernie Sanders positions in his economic plan, tax law changes are most likely to arise under his administration. This observation merely states that if you concerned how this might affect you from an estate and income tax perspective now is the time to plan.

If President Trump wins in November 2020 there is still the issue of who controls the House and Senate. The purpose of this quick overview is to raise awareness of potential issues of the Biden Tax Plan and to raise awareness regardless of wins. There are many unknowns. Please consult with your estate and trust planning attorney about how this might or might not affect your situation. Choosing an advisor friendly trust company should a corporate trustee be necessary requires a different discussion.

From an estate and income tax perspective the worst case scenario, following herd thinking, would be Joe Biden wins the White House and the House and Senate are controlled by the Democrats. Historically, whenever any party controls the Executive and Legislative branches, the infighting does not lead to radical change. The herd does not consider this possibility. I do. If Joe Biden’s wins the 2020 election and the House or Senate are controlled by the Democrats the proposed changes will be large. If Democrats win both Houses expect infighting. It happened to the Republicans during various times between 2001 and 2007 (interruption was between 2001 and 2003).

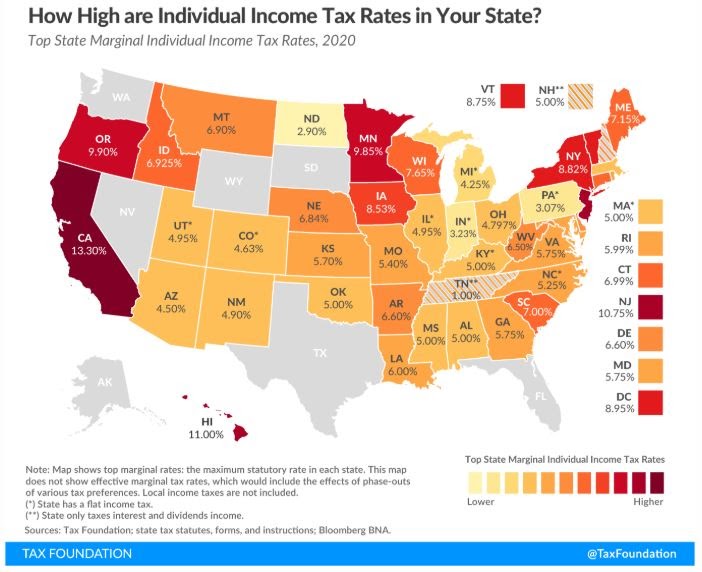

While considering these issues do not forget to consider your individual income tax rates at the state level. Your individual state income tax rate does not affect how the Biden tax plan would influence your overall tax rate unless some portions of the Tax Cuts and Jobs Act are repealed.

Although tax legislation is generally a lengthy process, there is concern over whether new laws passed in 2021 would be retroactive to January 1. Reviewing the Biden Tax Plan does not give any additional guidance. Given the possibility of a lower estate tax exemption and higher rates, you should consider opportunities to transfer assets out of your estate now in order to take advantage of the higher current gift and estate tax exemption. Strategies such as utilizing spousal trusts or gifting to trusts (see picking a trustee) for descendants are important options. Also, if you have highly appreciated stock positions or real estate and you wish to diversify, waiting until 2021 could expose you to significantly more tax on the sale of those assets. Here are few other ideas:

There are many families and individuals who are frozen around estate and tax planning. For example, people who planned and implemented that planning during the 2008 financial crisis experienced super rewards. Everyone should admit to the potential reasons for being frozen:

Waiting until November 4th to have these discussions could be too late. Given the time needed to analyze options and get anybody comfortable with a particular strategy, discussions should begin now. Additionally, transferring securities and obtaining tax identification numbers for new trusts at year-end can be a huge source of stress for anyone and advisors who are up against the clock during the holiday rush. Everyone should have an “election plan” in place before the election occurs. Waiting until too close to year-end could result in someone's plan not being implemented. Now is the time to create a plan with you are worried about the Biden Tax Plan or about how the House or Senate could change.

Disclaimer: None of these observations, comments and/or opinions should be considered legal or tax advice. Please consult with a licensed attorney on how any of these issues or others might or might not warrant a greater review on your particular situation today and into the future. .