Creating a trust requires people to surrender control of that wealth to someone else. For those who worked hard for the money or simply withstood the temptation to spend every dollar, handing the assets over to the trustee represents a tremendous leap of faith.

Agency trustee services solves that problem.

Many soothe the emotional stress by reaching for an individual — a relative or friend — who fills them with complete personal confidence. Some individual trustees accept the headaches, risks, and paperwork to do their own version of trust accounting and administration.

In the trust case, the trustee needs a lot of on-the-job training and support. They are looking for a plug-and-play solution such as agency trustee services. Either way, the administrative tasks that any formal trustee actually needs to perform can be overwhelming — and trustees must be in control.

At the very least, trustees need a lot of on-the-job training and support while they’re learning the system. Typically, a traditional corporate trustee does not want to present a middle solution — agency trustee services solution — because they lose control.

Even when trustees are willing to work with advisors, they’re usually more interested in grabbing the assets and holding on for the long term. They brag about how “sticky” these accounts are for them and their corporate affiliates, and this raises the stakes on any decision to direct your accounts their way.

Instead of a business relationship, many advisors get into a corporate marriage that’s very difficult to unwind and holding their best clients hostage in the process. Using an advisor-friendly trust company for agency trustee services prevents this possibility.

That long view is great for the institution, but it ultimately works against investors who crave flexibility in an increasingly high-paced technological environment and the volatile market universe.

Companies are in a constant state of flux. Until you’re absolutely sure you can rely on a corporate trustee to be a reliable partner for the long term, there’s not a lot of sense in committing to that kind of relationship.

Have an agency trustee services solution allows individual trustees to 'test' the corporate trustee concept for yourself.

One way or another, referring your clients to someone who can manage their trusts is becoming an essential piece of the advisory business.

After years of talk, the Baby Boomer wealth transfer is finally happening. There is an easy solution — agency trustee services. At least $30 trillion is at stake, and it’s moving into trusts at a rate of maybe $60 billion a year even as we speak.

How will you capture a piece of those assets?

Agency trustee services is one client-centric way.

Advisors who catch that wave can accelerate their growth while boosting retention across the generations. Obviously, only a minority of your closest competitors work with trusts now, so it’s a huge differentiator for you. And once the assets are in trust, you’re much less likely to lose control over how they’re invested when your current clients pass away.

Clients come and go, but a trust is theoretically immortal.

As long as the trust instruments appoint you as the investment manager, the heirs will be less likely to use someone else. However, this means being able to work with a wide range of trusts.

As it turns out, individual trustees are getting 70% of the assets, which means you’ve got to respect that urge to put a trusted relative or friend in the driver’s seat when your clients balk about handing their assets to a corporation to administer.

Your clients want to use agency trustee services because it gives them that personal connection with a steady hand of a corporate trustee.

A seasoned advisor can probably counter all of these arguments with hard facts about why running a trust is too much work for the typical untrained person, but feelings are difficult to overcome with even the best logic.

The easiest solution, of course, would be for the advisor suggesting the assets go into a trust and to volunteer to serve as trustee.

This provides the family with a solid combination of a familiar presence as well as freedom from administrative headaches. However, regulations have lots of rules for most advisors personally managing the money as well as administering the trust. Agency trustee services provides a solution to the advisor and client.

Given the choice, you’d probably rather hand off the trustee job and keep the wealth management under your umbrella. That means finding an advisor-friendly trust company who can do the job and inspire confidence in your client.

Confidence is a slippery thing based on chemistry and other intangible factors. If your client trusts that individual, that’s a good start. Building on that trust by suggesting agency trustee services solution raises your value as a consultant.

But the odds of an individual trustee getting in over his head are too high for any fiduciary to ignore. Running a trust takes a lot of specialized training and hard work. Missing a deadline or other details can cost the family a lot of money or imperil the trust itself.

Finally, the very relationship that the trust creator hopes to exploit can work against the individual trustee. Some beneficiaries will have closer bonds with the family trustee, while others may feel left out or slighted. If these disparities are allowed to fester, the emotional friction may eventually expose the trust and trustee alike to destructive litigation.

A completely impartial and expert corporate trustee brought in from the outside is the easy choice. But relatively few advisors have trust referral relationships in place anyway, and those who do still need to get their clients to sign off on the choice.

Searching for advisor-friendly trust companies offering agency trustee services starts the process to find an answer for your clients.

Until recently, the outcomes boiled down to forcing clients to go with a corporate trustee or appointing an individual. Then, you'd either hope for the best or table the trust conversation entirely.

But with the clock ticking on that $30 trillion, every trust is precious. How do you hit the ground running and build out the relationships as you go?

Good news: there’s a new plug-and-play model in town — agency trustee services.

Running a trust is a lot of work.

Advisors are only allowed to do it under very limited circumstances. Other individuals associated with the family can step in, but they’re usually unaware of the pitfalls and complications.

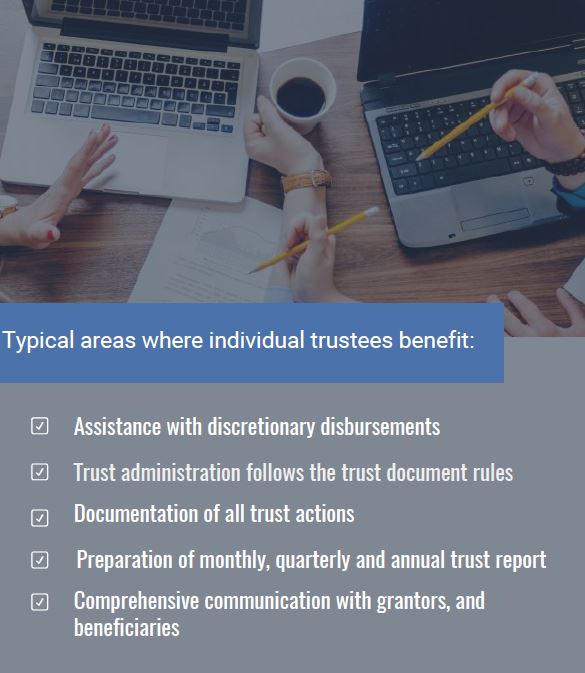

That individual needs backup — someone who knows the details of trust accounting, administration, the pitfalls, and the risks. If they want to learn how to do it themselves, they can ease off the support structure as he gets to know the ropes.

Otherwise, they can remain an amateur as long as they want, working with the beneficiaries while the advisor-friendly trust company provides experts with agency trustee services and tends to the details of all the trust headaches.

That kind of expertise is expensive to build. To amortize training costs, most trust organizations want the account forever and their business model is structured on that basis.

Wealth Advisors Trust Company already supports concierge-level trust service. We built the expertise. But unlike a lot of people, we’re happy to split the traditional trust relationship by focusing on administration and leaving the formal duties of dealing with the beneficiaries and reviewing the investments to any individual the trust creator appoints.

That is the beauty of an agency trustee services. The individual trustee has the best of both worlds — retaining total control of the trust and using a world-class trust company to do all of the trust administration.

In summary, agency trustee services help in the following ways:

Every intervening minute, the trusts on our platform are properly handled in the background. And in the foreground, the grantors and advisors retain complete freedom of movement.

You can recommend whatever investments you like. You retain fiduciary oversight. You have 100% control over custody. The agency trustee services provide the flexibility to any individual trustee.

Maybe a temporary relationship turns into something deeper. That’s obviously our hope, but in the meantime, your client assets have a place to stay, as long as they need it.

Your clients have a trained corporate trust staff working in the background to anticipate their needs.

We’ve worked with a lot of trusts and helped resolve complex issues.

We haven’t seen it all, but we’ve definitely managed tricky situations involving fractious beneficiaries, vague trust documents, and exotic assets that would stymie most untrained individual trustees.

And if we notice a trustee potentially making unwise decisions — subtly — we will provide our expert trust opinions.

Our legal and tax advisors know the statutes and IRS regulations. We’ll keep them on track. That is a large part of our agency trustee service.

Consider the case involving the multi-billion dollar estate left to the Rollins family, the clan behind the Orkin pest control empire.

In 1968, O. Wayne Rollins, who set up the Rollins Children's Trust with his brother, named his sons Gary and Randall as trustees of his estate and heads of family-held corporations. He also named a close family friend, Henry B. Tippie, as a third trustee.

The trust was originally funded with company stock to be paid out to Wayne’s nine grandchildren on their 25th and 30th birthdays, with the remainder going to the next generation.

Almost 20 years later, Wayne set up an additional nine subchapter S trusts — one for each grandchild — in an effort to reduce his tax bill.

Following Wayne’s death in 1991, things rolled along smoothly for a while until the trustees began requiring the grandchildren to have “meaningful pursuits” and instituting a “monitoring program” to ensure compliance.

In 2001, Gary’s four children rebelled against the oversight, and sued all three trustees in an initial suit that claimed that they were being denied their rightful distributions by overzealous trustees who had breached their fiduciary duties.

A corporate trustee could rightly claim impartiality. But family friends, fathers and uncles don’t have that institutional shield to hide behind.

Years later, the case was still being fought out in courtrooms throughout Georgia amid claims of financial mismanagement and self-dealing. In the meantime, family ties completely broke down.

Instead of having the best of both worlds, the Rollins dynasty wound up fragmented and paying the litigators a lot of money.

An individual trustee may or may not become an expert in his own right. Either way, they are not going to be around forever.

By the time they are gone, the initial bonds that drove the family to appoint him in the first place have weakened.

It’s probably time to appoint a corporate trustee for the long term.

If the advisor recommends an agency trustee service from the beginning the concept of using an advisor-friendly trust company are natural.

The trust agency services that an advisor chooses must navigate the everyday processes of running a trust and the exceptions that inevitably emerge.

Remember, the individual trustee has ultimate responsibility for documenting the distributions and administering the trust. Ask for examples of how the advisor-friendly trust company has dealt with unusual circumstances or stepped in to repair problems that a less adroit administrator or third-party partner created.

You want to see proof of experience in record-keeping and seamless collaboration between investment advisors, CPAs, and attorneys.

Look for a partner that has no interest in using its access to trust creators and beneficiaries as a prospecting channel. A good choice may or may not support an in-house wealth management operation, but it will definitely refuse to interfere with existing outside advisory relationships.

The investment and custody platform should be completely open architecture. Proprietary products are generally a sign of tension ahead.

Deciding how, when, and to whom the grantor wants assets distributed is very personal. When working with a corporate trustee agency services, advisors can be confident that their clients’ privacy will be protected.

While certain states require full disclosure to beneficiaries, a reputable corporate trustee will do all that it can to retain the trust’s privacy. But that process takes time. The important thing now is getting that trust into a safe, comfortable place with all the amenities.

Financial advisors and their clients, acting as individual trustees, now have a solution. Use Wealth Advisors Trust agency trustee services.

When the client decides they want a full-time corporate trustee, the financial advisor continues to manage the trust assets, and the advisor-friendly trust company does the trust administration.

That's a win-win.

To learn more about how Wealth Advisors Trust Company works and what makes us different, take a look at the details of our agency trustee services.