Irrevocable Life Insurance Trusts (ILIT) are sought out tools used in estate planning practices to shelter an estate from paying high estate taxes. When someone chooses to include an irrevocable life insurance trust inside their estate plan, most of the time they want a clear understanding of what it actually is.

In this article we will cover the history of Irrevocable Life Insurance Trusts, the benefits, corporate trustee responsibilities, and a few other important key factors. After reading this article you will be equipped with information needed to understand the ins and outs of irrevocable life insurance trusts. After you have gained a better understanding be sure to speak with your estate planning attorney to effectively formulate your plan.

Life insurance is another name for death insurance2. It is a tool used to commonly protect families from the impact of the loss of income, and leave behind an inheritance for beneficiaries. The significance of life insurance is that, it shifts the risk from the policy owner to the insurance company. The dynamics of how life insurance works is simple. When individuals buy an insurance policy, they are required to pay a certain amount in order to receive a certain amount at death. The amount that is paid is called the premium. The premium can be paid monthly, quarterly, or even as a lump sum. These payments are taken and pooled together in order to pay death claims. In essence, the people who have purchased life insurance to protect their families in the event of death, are the ones who compensate the individuals who die prematurely. In legal terms, life insurance can be used as a Will substitute. Referring to I.R.C § 2042, life insurance is a tool that is a non-probate transfer and included in the gross estate if, the policy is paid to a decedent's probate estate, or if an incident of ownership was possessed at death2 .

There are two main types of life insurance: Permanent life insurance and Term life insurance. There are many other different types of life insurance policies such as universal, variable, guaranteed, and permanent. However, with an irrevocable life insurance trust in the past, the most commonly used was whole life insurance and term life insurance. Recently, more and more ILITs are holding guaranteed universal life insurance because the individual is only paying for the death benefit.

Permanent life insurance is also referred to as straight or ordinary life insurance. This type of policy can become endowed and no further premiums are owed. These types of policies are more expensive because they guarantee a payment amount owed by the insurance company to the insured, and the guarantee of cash value. Thus, they are cheaper to get earlier in life rather than later. A cash value is a benefit that is separate from the death benefit. It is only a component of permanent life insurance.

Term life insurance is cheaper and the simplest form of life insurance. Term life insurance policies only require insurance companies to pay death benefits during a certain time frame. 2These time frames are either 5, 10,15,20, or 30 years. Term life insurance is far less expensive than permanent insurance because it is only for a certain amount of time and offers no cash value. These types of policies are generally great for covering times when there are young beneficiaries and the parents are looking to protect them in case of an accident. Most term life insurance policies also include provision to convert the term policy to a permanent policy at some time in the future.

An Irrevocable trust is a type of legal arrangement that is setup by an individual in order to benefit another individual or multiple individuals. It is administered by a trustee. This involves ongoing administration of the trust property in accordance with what the grantor of the trust would have wanted. A trust is an agreement for a trustee to hold property for another, known as a beneficiary. A trustee must understand the intent, and other factors including contingent and vested interest.

The three legal participants of a trust are the grantor, beneficiary, and trustee6:

There are two different types of trusts. The first is a revocable trust, and the second is an irrevocable trust. A revocable trust can be changed at any time. An irrevocable trust is a trust that cannot be changed. This means that it cannot be amended, modified, or revoked. 2Creating a trust is another alternative to creating a will. A trust will not be subject to go through probate. It also allows you to protect certain property from creditors and judgements because 2once the ownership has been transferred it can't be taken back.

An irrevocable trust comes in two forms: living trust and testamentary trust. A testamentary trust is revocable, and at death it becomes irrevocable. This is because the trust is not funded until after the creator of the trust has passed away. When the trust goes into effect, the creator is no longer alive. Therefore, the trust becomes irrevocable automatically.

A living trust is created and funded while a person is alive. 2This type of trust is also referred to as an, "Inter Vivos”, trust. At the death of the creator, the trust then becomes irrevocable and no changes can be made to the trust. There are other types of irrevocable trusts such as an irrevocable marital trust, also called a bypass trust, irrevocable charitable trust, and a charitable remainder trust. With so many options to choose from it is very important that you consult with a licensed professional before making the decision.

An ILIT is a living trust that is established to own a life insurance policy5. The policy is purchased by the trust as supposed to being purchased by the owner in order to avoid being counted in the owner’s estate. The “policy” (sometimes known as “contract”) is the insurance product that was purchased within the trust. Whether it is a universal life, whole life, or term it is the contract that determines what premiums are paid into the policy and what death benefits are paid out of the policy. As mentioned earlier, the premium is the amount that is determined by the contract, but can be changed by reassessment of the performance of the contract. It is required to be paid into the policy in order to secure the intended death benefit of the policy.

Irrevocable life insurance trusts (ILITs) provide clients with liquidity to support spouses and children, remove assets from the client’s estate for estate tax purposes, and provide long-term asset protection for all family members4. Despite all of the benefits, ILITs are poorly administered and thereby reduce the benefits sought by clients. Circumstances often change in a client’s life and an existing ILIT might no longer meet his or her estate planning goals. Individuals also setup ILITs in order to control from the grave, or create an estate equalization. For example, if a policy owner owns a business and has three kids, but only one of the kids works for the business, they might gift that one child the business, then purchase a policy in an amount equal to the business value for the other two.

Individuals with large life insurance policies are sometimes, but not always, aware that their estate might include the insurance proceeds. If you have a substantial life insurance policy, your attorney might suggest that creating one might be a good option.

To start, an irrevocable trust is created and names a trustee. The insurance policy is purchased by the trust or transferred into the trust, making the trust the owner of the policy. Since the trust is irrevocable, the original owner no longer has control over the policy3. The creator of the ILIT cannot also serve as trustee. However, they can control how premiums will be paid, who will receive the benefits, and how the payments will be made to beneficiaries.

Here are the most common administration concerns or changes in circumstances involving ILITs:

The irrevocable life insurance trust was created to provide a tax shelter for grantors and beneficiaries4. Under codes such as §2503(b) and §2503(c)1 of the Internal Revenue Code allows the transfer or gift to a beneficiary known as a “Crummey power”, to qualify an entire gift amount of a transfer exclusion1. Crummey powers1 were created from the case Crummey vs.Comm’r, 397 F. 2d 82 (9th Cir. 1968). When a beneficiary is not mature enough to be able to be operate the ownership of property, the Crummey power operates the control for those beneficiaries2. Every year the grantor makes distributions into the trust known as a gift. Each beneficiary is able to withdraw from the trust annually. They are able to withdraw in the amount that is transferred to the trust by the grantor during that same year, up to the amount that is equal to the annual exclusion amount. The trustee is responsible for paying the income to the beneficiaries or if they choose, to accumulate the income. This is at the trustee’s discretion which is dependent upon the language that is in the trust document. The trust will terminate when the beneficiaries reach a certain age. If the beneficiary does not take the distribution that was gifted to the trust, then the distribution becomes a part of what is known as the trust corpus2. Therefore, the power for the beneficiary to take the distribution now lapses1. This qualifies the transfer from the grantor under I.R.C.§2503(b) exclusion because the beneficiary had the right to take the gift but chose not to.

To understand how trust law could evolve, it helps to know where it began. Here is a quick note:

Trust law has existed for 2,000 years. The foundation of current U.S. trust law is from Roman and British law. The Roman Empire established the legal concept of a testamentary trust (created within a will). The signing of the Magna Carta in 1215 in England allowed the legal concept of individuals owning property and assets. The concept of a living trust (also known as a revocable trust) emerged due to the Crusades.

The grantor cannot be the beneficiary of the irrevocable life insurance trust. The need for ILITs has changed significantly over the last couple of years due to the federal estate tax exemption rising to 11.2 million back in 2018, and currently at $11.5 million, this allows a married couple to have $23 million shielded from federal estate tax for beneficiaries. Years ago, exemption amounts were around $675,0007. This created heavily taxed estate plans. A life insurance policy alone would be able to push an affluent family well over the minimum for the estate tax exclusion. This created the argument to even owning a life insurance policy or having an irrevocable life insurance trust. A key factor to understand is the term “incident of ownership” and the role that it plays. The incident of ownership is the power to cash in policy, borrow against a policy’s cash value, or change beneficiaries. Under section I.R.C.§2042, if an insured possesses any type of incident of ownership over a policy, then it is fully included in the insured's gross estate2. Thus, the life insurance policy is paid to the trust and is taken out of the grantor's estate.

The biggest advantage of using an Irrevocable life insurance trust is that you are moving the assets out of your estate5. As mentioned before, this helps to reduce your state tax liability. Oftentimes if an individual purchases a large amount of life insurance they can put themselves in a position to face a large estate tax liability. 7Once the life insurance trust is created; the life insurance policy is now separated from the estate which saves you from the tax burden. Another advantage with an irrevocable life insurance trust, is that the owner is given more control over the distributions to beneficiaries. For example, the grantor can choose to only give distributions to a beneficiary at the age of 25, 30, or 40. These types of restrictions prevent beneficiaries from becoming, “trust fund babies”. When the grantor creates the ILIT you can select who is going to be the manager. This is another example of the control the grantor has to choose a trustee. When the grantor is picking a trustee, he or she can choose a trustee who only does the trust administration, such as distributions, tax filing, etc., and choose to continue using their financial advisor. We will cover this more later on.

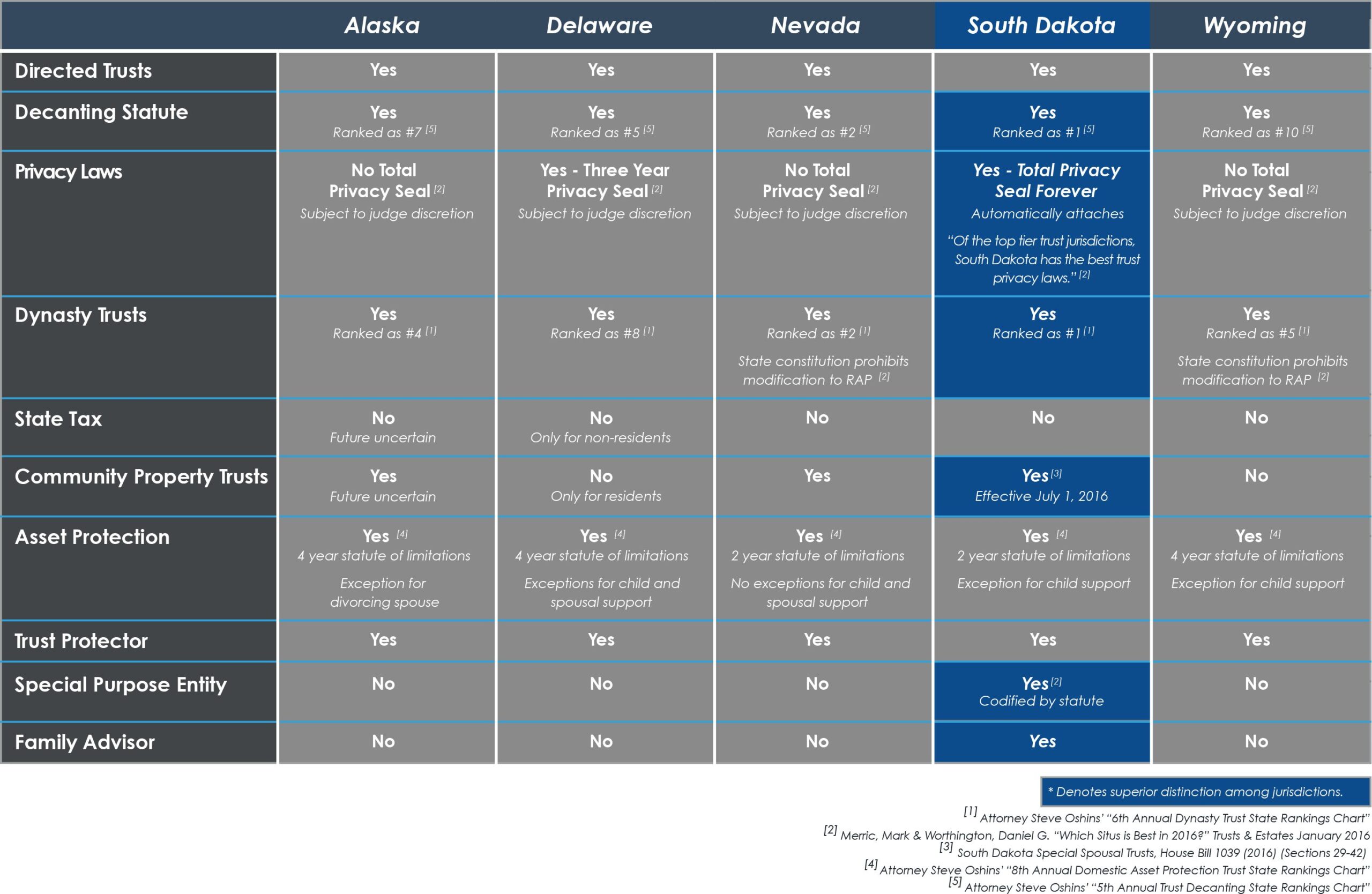

Irrevocable life insurance trusts can also be made private5. States like South Dakota do not file trusts publicly and is a top jurisdiction for privacy laws with trusts. Lastly, since life insurance distributions are shielded from creditors, this can provide asset protection to further shelter beneficiaries5.

Creating a new irrevocable life insurance trust will give the client a “fresh start” and allows the client to plan with hindsight. When creating a new irrevocable life insurance trust, the client should consider the following:

ILITS enjoy receiving the death benefit of any policy free from inclusion in your gross estate at death. This is a significant difference of a life insurance policy benefit that is received directly to an individual. Like a standard irrevocable trust, ILITs are significantly more protected from litigation and creditors. ILITs also protect the beneficiaries the same way through the distribution language outlined in the trust agreement. An additional and unique feature of an ILIT is the assistance of estate liquidity. You are able to swap assets between your estate and your ILIT at death. This allows to preserve hard assets, such as a house, from having to be liquidated to pay estate taxes or other necessary expenses at death.

An irrevocable life insurance trust is a great tool for asset protection, and helps individuals protect their family in the case of a loss. Unfortunately, life insurance trusts do have a few cons. One of the biggest issues with life insurance trust is that the grantor endures a loss of control also. Irrevocable life insurance trust is used by the grantor to be taken out of their estate. Whenever the trust is created their grantor must choose a trustee. When the trustee is chosen the grantor relinquishes control of the trust assets. Another con, life insurance trusts are not as necessary because the federal estate exemption amount is at $11.5 Million. This is up significantly from years prior. However, this will sunset in the year of 2025. An important factor to consider is 2020 being a new election year which could potentially reduce federal estate tax exemption. Other cons include creation of the trust can actually be quite expensive, and an irrevocable life insurance trust cannot be modified4. This can present many challenges for the grantor if they want to later make changes to the trust. It can be done, but it can become very expensive. If the grantor has passed away a trustee may be able, depending on the state, to utilize a non-judicial settlement agreement and the decanting statutes. The decanting statutes are dependent on the state law. South Dakota, has ranked number one for the past 7 years according to Steve Oshins, a top estate planning attorney, to have the best decanting statutes in the country.

Someone who is unhappy with how their ILIT is being administered, or wants to make changes has four options:

The trust also must have held the life insurance policy 3 years prior to the passing of the owner of the trust. If the life insurance is not owned by the trust within those 3 years then the IRS will not honor the ILIT. A work around would be if the life insurance policy was purchased when the ILIT was created, then the IRS will look at the life insurance policy to have always been controlled by the estate.

A trustee has four main duties, known as the four functions of trusteeship2. These four functions overlap and involve the following; custodial, administrative, investment and distribution2. The custodial function is for the trustee to take custody of the trust assets. It is their responsibility to properly safeguard the trust property. The administration function, which we will discuss further in this guide, involves the trust accounting, record keeping, compliance, and tax filings. The investment function, includes managing the investments of the trust assets, and creating strategies that are in the best interest of the beneficiaries. In South Dakota, a trust can be Directed or Delegated. This gives the owner the flexibility to separate the duties of who manages the money, and who invests the trust assets. Lastly, the distribution function is for the trustee to distribute the assets inside the trust to a designated beneficiary. Depending on the terms of the trust, these distributions can be taken from either income, principle, or both.

There are three different types of trustee’s: individual, bank, and independent. An individual trustee is usually a family member or friend. A bank trustee is attached to a bank trust department. An independent trustee, is a trustee that is not tied to a bank. Independent and bank trustees are trust companies that manage, invests, and administers the trust assets. Though there are many different types of trustees, their responsibilities remain the same. A trustee has 5 main responsibilities of administering an irrevocable life insurance trust.

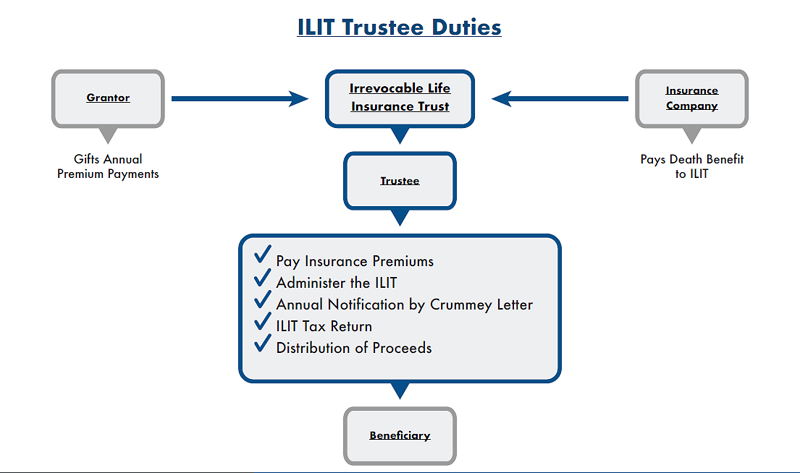

Below is a diagram of trustee duties.

The type of trustee you choose will implement different roles. For example, an independent trustee, Wealth Advisors Trust Company, only administrates the ILIT. In the trust document the Grantor provides the direction, chooses the investment manager, and is released from burden of responsibility.

Trustees have an array of responsibility when executing an Irrevocable Life Insurance Trust. Knowing how to choose the right Trustee to manage the ILIT will save a lot of frustration, time, and money. In order to make that decision easier, this article will highlight what a trustee is supposed to do.

Earlier, we discussed the history of ILITs, and creation of the Crummey. From a tax perspective, this is a necessary vehicle to understand when creating an estate plan. One important factor to first understand for not only ILITs, but any type of trust is that state jurisdiction is very important. South Dakota and Texas do not have a state income tax. However, states like Washington do not have state income tax, but they have an estate tax. The current exemption is just under $2.2 million, anything above this threshold will be subject to the estate tax. This goes to show that not all states trust law is the same, and should be considered when creating any type of trust.

Below is a top trust state comparison chart.

Life insurance proceeds are not included in the beneficiary’s gross income. The proceeds are used to pay estate obligations. Life insurance is also used as a strategy to pay debts and taxes without having to sell any assets.

Therefore, the beneficiaries do not owe an inheritance or death tax on the proceeds. The estate is what pays the federal tax. Whenever a grantor makes a “gift” to a trust they can avoid paying gift taxes on amounts up to $15,000 which is the threshold for the gift tax exclusion7. The $11.5 million exclusion amount shelters smaller estates from paying the estate tax, which is imposed on estates with assets exceeding the amount. Since the gift to an insurance policy to a trust is normally considered a future interest, then it is not eligible for current interest3. An insurance policy does not account for income to be distributed to a beneficiary. Under Crummey, a gift of cash to the trust will qualify for the annual exclusion if beneficiaries are provided with a demand right.

Here is an example:

Tom is a very wealthy man and he owns a piece of property that is worth $15,000,000. He has been divorced for 10 years and has 3 kids. At death, Tom would be subject to pay $1.4 million to the federal government. If Tom decides to buy an insurance policy to shield this additional cost, then his estate will be increased by that amount and he will be taxed on an additional 40% of that policy2.

Perhaps Tom decides it is better to purchase an ILIT that buys the insurance policy instead. If he buys a $2 million policy with an annual premium of $30,000, the life insurance proceeds will not be included in Tom’s estate when he dies. Since Tom's annual contribution to the trust is $30,000 for 3 beneficiaries, the gifts will not be subject to paying a gift tax2. The 3 kids would now hold the Crummey powers to withdraw, and would receive a higher amount without having to pay any gift tax.

Sometimes a grantor might consider paying insurance premiums through a different type of investment vehicle. If a grantor has an asset that produces income, why could they not be able to use that income to pay insurance premiums? Unfortunately, I.R.C.§677(a)(3) causes the grantor to be taxed on that income. This cancels the tax advantage of the grantor of the irrevocable gift of the income from the asset1.

For anyone with an estate (e.g. the value of your assets when you pass away) larger than the current federal tax exemption amount, an ILIT may be a good solution. As always, the cost of creating an ILIT, maintaining it, the ILIT trustee fee schedule and paying for the life insurance all go into deciding whether they are practical. If you are creating a trust through a law firm the cost can be from $1,000 to $8,000. However, the administration fees for ILITs are typically lower than fees for personal trusts. The reason being is that a typical ILIT does not have that much work that needs to actually be done. At Wealth Advisors Trust Company, the fee charged for administering on irrevocable life insurance trusts is $1,500. This is a base fee. Any additional life insurance policy that is added is an additional $500. There is also a setup fee that is $750. In the trust industry, you will typically see around this range. Some firms may also charge a termination fee. This fee is typically charged if the amount of the irrevocable life insurance trust is taken by the beneficiaries as a lump sum. These fees can be charged as a percentage such as 1% to 3%, or as a flat fee that ranges anywhere from $1000 to $10,000.

Depending on the type of trust company or individual trustee you choose will determine the amount of fees you will have to pay. As we briefly covered earlier, there are three different types of trustees: Individual, Corporate, Bank. Here is further detail:

Keep in mind if you are using an individual such as a friend or a family member, they may not charge a fee. However, there are some downsides with working with a friend or family member. For example, even though they do not charge a fee they are not able to constantly track the new laws that are constantly being implemented. Also, there have been times when an individual trustee has shown favoritism to beneficiaries. These are just a few of the risks that go along with choosing a family or friend to administer and invest the trust assets. The good news is that you are able to have the best of both worlds. Trust companies offer what is known as agency trustee services. This provides the flexibility to be able to use your friend or family member to serve as an individual trustee, and have the benefit and the support of using a Trust Company.

Step #1:

Gifting to the Trust: An ILIT works so well because it takes advantage of the tax break allowed for gifts. Remember, this is called the annual gift tax exclusion. In order to exercise this, your trustee will provide you with a gift request letter indicating the amount of funds needed to cover the annual premium. You then gift the funds to the trust in order to satisfy the policy requirements (and any other fees associated with the administration of the ILIT account). Each year, 60 days prior to the due date of the premium, Wealth Advisors Trust Company will send you a “Gift” letter.

Step #2:

The receipt of “Notice of Gift and Right of Withdrawal Letters” to the beneficiaries, also known as “Crummey” letters”: Once Wealth Advisors Trust Company receives a gift to the trust, from you, we then prepare “Notice of Gift and Right of Withdrawal Letters” and send these letters to the beneficiaries, also known as the Crummey recipients.

Crummey recipients are typically the beneficiaries you named in the trust agreement. The “Crummey Letter” notifies the Crummey recipient that a gift (otherwise known as a deposit) has been received on behalf of the trust and provides the recipient a 30-day window for the recipient to exercise their right of withdrawal.

This is an important step: In order for the IRS to count the deposit received into the trust as a “gift”, the gift has to be accessible to the Crummey recipient(s) for withdrawal for at least a limited amount of time. Wealth Advisors Trust Company provides 30 days for a Crummey recipient to exercise their right of withdrawal. At the end of the 30-day term, the withdrawal typically lapses and the trustee proceeds to pay the premium on the insurance policy. This is why we have to request a gift 60 days before a premium is due and why it is important to be timely. The trust company has to observe the Crummey period and consider the mail time of these letters as well as the processing of the premium payment itself without jeopardizing the insurance policy.

It is important for you to have a conversation with the trust beneficiaries, again, known as Crummey recipients, to inform them as to what to expect and the purposes of the funds gifted to the trust. On occasion, a recipient may not be aware of the long-term plan and exercise their right of withdrawal for the gift, which places a much greater sum in jeopardy. Oftentimes, once a recipient understands that this process is to ensure a greater long-term benefit that could be 100x greater than the current gifting amount, they are quick to waive their rights of withdrawal. Failure to have an informative conversation with any Crummey recipient, can lead to adverse issues, namely the trustee not being able to pay the premium on your life policy held in trust, thereby causing it to lapse or underperform. It is important to make sure all recipients are aware of the intended ILIT process, so the trust can perform as planned.

This guide provided you with things to consider when formulating your own estate plan. Understanding, the ins and outs of certain types of investment tools can better equipped you to make the best decision.

If you are in the process of choosing a trustee, a corporate trustee might be a good option. Your estate attorney can help guide your decision. Corporate trustees offer many benefits. They give individuals more choice and control over how the trust is invested and administered. Whichever trustee an individual chooses to manage their ILIT, should understand what the responsibilities are. Knowing this will be helpful when deciding who's going to manage the trust assets.

When creating a trust, it is important to understand the steps that need to be taken. Be sure to take note of your assets and property to know what you would want to place inside the trust. Once you have decided what you want to happen, spoken with an attorney, and picked a trustee. You will be able to create a plan for your future.

Notes: